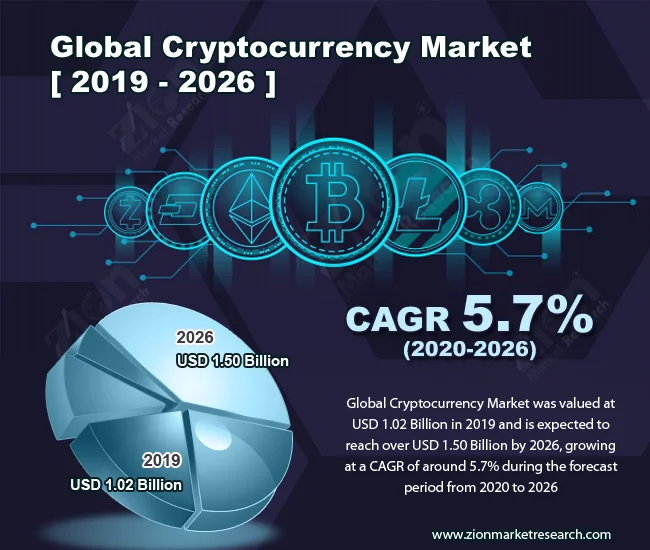

Why Crypto's Downturn is a Paradigm Shift (r/Crypto)

Goldman Embraces Crypto: A Glimpse of Finance's Future?

Okay, everyone, buckle up! Because something HUGE just happened, and I honestly think it might be one of those moments we look back on as a real turning point. Goldman Sachs—yes, that Goldman Sachs—is diving even deeper into the crypto world with the acquisition of Innovator Capital Management. [https://www.example.com/goldman-innovator] I mean, Goldman Sachs! The financial behemoth, the old guard, is making a multi-billion dollar bet on defined outcome ETFs, those special funds that use options to limit risk and cap gains.

Now, some might see this as just another business deal, another headline in the endless stream of financial news. But I see something much bigger. I see a validation, a sign that the old walls are finally starting to crumble, and a future where traditional finance and the crypto world aren't separate kingdoms, but a single, interconnected landscape. What this means for us, for you and me, is a whole new level of accessibility, security, and—dare I say it?—legitimacy for the digital asset space.

A New Era of Financial Integration

Think about it. For years, crypto has been the rebel, the outsider, battling for acceptance in a world dominated by institutions that seemed determined to keep it at arm's length. We've heard the skepticism, the warnings, the endless debates about whether Bitcoin is a fad or the future. But now, one of the biggest players in the game is saying, "We're in. We see the value. We're building the bridge."

The Scale of Goldman's Crypto Investment

The scale of this is amazing. With Innovator's US$28 billion in assets, Goldman Sachs' ETF portfolio is about to balloon to US$79 billion. That's a massive injection of traditional capital into a space that, let’s be honest, has often felt a bit… isolated. And it's not just about the money, it's about the expertise, the infrastructure, the regulatory compliance that Goldman Sachs brings to the table.

A Paradigm Shift in Finance

Remember when the printing press was invented? Before that, knowledge was controlled by a select few, carefully guarded and difficult to access. The printing press democratized information, putting it in the hands of the masses and sparking a revolution in thought and culture. This move by Goldman Sachs feels like a similar kind of paradigm shift. It's like saying, “Okay, crypto, you’re not just for the early adopters and the tech-savvy anymore. You’re for everyone.” What does this mean? It means that the future of finance is not decentralized vs centralized, but a hybrid.

Of course, this integration comes with its own set of responsibilities. We need to ensure that this newfound legitimacy doesn't come at the cost of innovation or the core principles of decentralization. We need to be vigilant about regulation, making sure it fosters growth and protects investors without stifling creativity.

The Future is Decentralized, But Grounded.

But you can't deny the excitement. The news isn't all positive, though. There's been some turbulence in the market, with Bitcoin experiencing a sharp decline recently [https://www.example.com/bitcoin-price-drop]. But even in the midst of these dips and corrections, there are glimmers of hope. As Linh Tran, a market analyst at XS.com, pointed out, these corrections can actually create a "cleaner base for future recovery." It’s like the market is pruning itself, getting rid of the dead weight to make way for new growth. Recent reports suggest that the Crypto Market Enters a Stabilisation Phase, Experts Say, which could signal a more predictable investment environment.

Altcoins Showing Promise

And speaking of growth, check out what's happening with SPX6900! This altcoin is showing some seriously promising signs, with a bullish reversal pattern that could lead to a significant rally. [https://www.example.com/spx6900-analysis] It's a reminder that even as the big players make their moves, there's still plenty of room for smaller, innovative projects to thrive.

I saw someone on Reddit say, "This is it, folks. The institutions are here to stay. Time to buckle up and get ready for the ride." And honestly, that's exactly how I feel. When I first saw this news, I literally just sat back in my chair, speechless. This is the kind of breakthrough that reminds me why I got into this field in the first place.

The Dawn of Hybrid Finance

So, what does this all mean? It means that the future of finance is not about one world replacing another, but about two worlds coming together, learning from each other, and building something new and better. It means more opportunities, more innovation, and a more inclusive financial system for everyone. But more importantly, what could it mean for you?

Are You Ready for the Future of Finance?

I'm ready to embrace this new era. Are you?

-

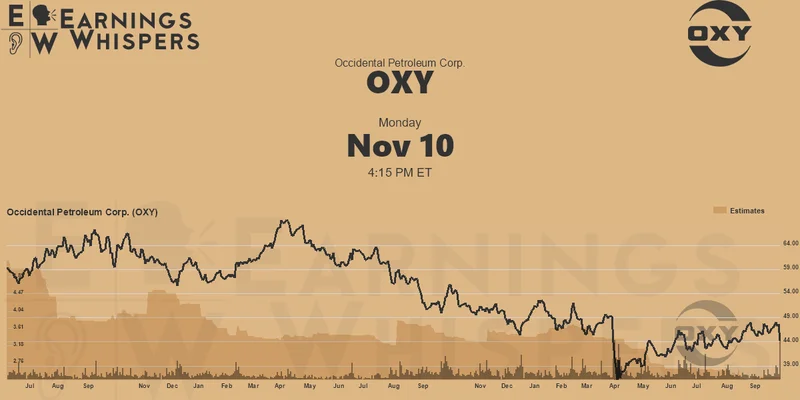

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

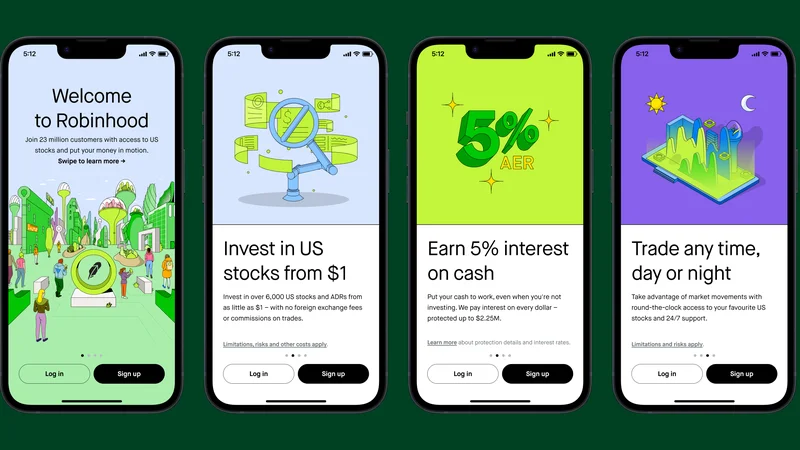

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Why Crypto's Downturn is a Paradigm Shift (r/Crypto)

- Dow, S&P 500, Nasdaq Edge Higher: The Data Behind Six Gains in Seven

- Stocks & Crypto Rebound: Bitcoin Clears $90K, Tech Leads Higher: The data behind the bounce and the real catalysts

- Why Stocks, Gold, AI Soar: Bitcoin's Hidden Truth - Crypto Twitter Reacts

- Crypto Market: Still a House of Cards. - Debate Ignites

- Bitcoin's Surge: The Future Just Accelerated - Reddit Gobbles Gains

- Crypto Rally: Bitcoin and Altcoins Up: What the Numbers Say - Redditors Rejoice!

- Community Fires Back: The Truth About Bitcoin's 'Collapse' - Crypto Twitter Reacts

- Manufacturing's AI Pivot: Hype vs. Data - Bots Assemble!

- 2025 DeFi: Post-Crash Reality Check - Twitter Reacts

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)